UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 as amended

Filed by the Registrantxý

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

| ||||||

| ||||||

| ||||||

| (Name of Registrant as Specified In Its Charter) |

ASCENDANT SOLUTIONS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and | ||

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: |

Your vote is importantTexas 75230

972.250.0945

To

April 30, 2018

ASCENDANT SOLUTIONS, INC.

Proxy Statement

2005NOTICE OF THE 2018 ANNUAL MEETING OF STOCKHOLDERS

Ascendant Solutions, Inc.

16250 Dallas Parkway, Suite 102

Dallas, Texas 75248

972-250-0945

April 8, 2005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 9, 200516, 2018 at 1:30 PM

Ascendant Solutions,Dougherty’s Pharmacy, Inc. (“Ascendant Solutions”("Dougherty’s Pharmacy" or the “Company”"Company") will hold its Annual Meeting of Stockholders at its corporate headquarters located at 16250 Dallas Parkway, Suite 102,8343 Douglas Ave, Dallas, Texas 75248 75225 in the Lone Star conference room on the lower level,on May 9, 200516, 2018 at 1:0030 pm.

We are holding this meeting:

| 1. | To elect one Class |

| 2. | To ratify the Company’s appointment of Whitley Penn LLP to be the Company’s independent registered public accounting firm for fiscal year 2018; and |

| 3. | To transact any other business that properly comes before the meeting. |

Your board of directors recommends that you vote in favor of the proposalproposals outlined in this proxy statement.notice.

Your board of directors has selected April 1, 200513, 2018, as the record date for determining stockholders entitled to vote at the meeting. A list of stockholders on that date will be available for inspection at Ascendant Solutions, Inc., 16250 Dallas Parkway,the Company’s offices located at 5924 Royal Lane, Suite 102, Dallas,250, Texas 75230, for at least ten days before the meeting.

This notice of annual meeting, proxy statement, proxy and our 2005 Annual Report to Stockholders are being distributed on or about April 8, 2005.

You are cordially invited to attend the meeting in person. However, to ensure your representation atobtain a quorum for the meeting, you are urged to mark, sign, date and return the enclosed Proxy as soon as possible in the envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if he or she previously returned a Proxy.

By Order of the Board of Directors,

Gary W. Boyd/s/ James C. Leslie

Vice President-Finance andJames C. Leslie

Chairman of the Board, Interim President, Interim Chief Financial Officer and Secretary

TABLEImportant Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 16, 2018: This proxy statement and the company’s 2017 Annual Report on Form 10K are available at www.doughertys.com.

DOUGHERTY’S PHARMACY, INC.

1101 East Arapaho Road, Suite 200

Richardson, Texas 75081

PROXY STATEMENT

for

ANNUAL MEETING OF CONTENTSSTOCKHOLDERS

to be Held May 16, 2018

SOLICITATION AND REVOCABILITY OF PROXIES

The enclosed proxy (the “Proxy”) is being solicited on behalf of the Board of Directors (the “Board”) of Dougherty’s Pharmacy, Inc. (the “Company”) for use at the Annual Meeting of Stockholders (the “Meeting”) to be held at 8343 Douglas Ave, Dallas, Texas 75225 in the Lone Star conference room on the lower level, on May 16, 2018 at 1:30 pm, or at such other time and place to which the Meeting may be adjourned. Proxies, together with copies of this Proxy Statement, are first being mailed to stockholders of record entitled to vote at the Meeting on or about April 30, 2018.

Execution and return of the enclosed Proxy will not affect a stockholder’s right to attend the Meeting and to vote in person. Any stockholder executing a Proxy retains the right to revoke such proxy at any time prior to exercise at the Meeting. A Proxy may be revoked by delivery of written notice of revocation to the Secretary of the Company, by execution and delivery of a later Proxy or by voting the shares in person at the Meeting. If you attend the Meeting and vote in person by ballot, your proxy will be revoked automatically and only your vote at the Meeting will be counted. A Proxy, when executed and not revoked, will be voted in accordance with the instructions thereon. In the absence of specific instructions, Proxies will be voted by those named in the Proxy “FOR” the election as directors of those nominees named in the Proxy Statement, “FOR” the approval of each of the other proposals as recommended by the Board and as further described in this Proxy Statement, and in accordance with their best judgment on all other matters that may properly come before the Meeting.

RECORD DATE AND VOTING SECURITIES

Only stockholders of record at the close of business on April 13, 2018 are entitled to notice of, and to vote at, the Meeting. The stock transfer books of the Company will remain open between the record date and the date of the Meeting. A list of stockholders entitled to vote at the Meeting will be available for inspection at the executive offices of the Company. On the April 13, 2018 record date, the Company had 23,087,164 issued and outstanding shares of its common stock (the “Common Stock”).

QUORUM AND VOTING

The presence at the Meeting, in person or by Proxy, of the holders of a majority of the shares of Common Stock issued and outstanding is necessary to constitute a quorum. Holders of Common Stock are entitled to one vote for each share of Common Stock held on each matter to be voted on at the Meeting. All votes will be tabulated by the inspector of election appointed for the Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes are counted as present for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions will be counted towards the tabulations of votes cast on matters presented at the Meeting and will have the same effect as negative votes (other than the election of directors) whereas broker non-votes will not be counted for purposes of determining whether a matter has been approved.

Assuming the presence of a quorum, the following paragraphs describe the vote required by the stockholders of record to approve each of the proposals set forth in this Proxy Statement.

YOUR VOTE IS IMPORTANT.

PLEASE REMEMBER TO PROMPTLY

RETURN YOUR PROXY CARD.

| · |

The Board unanimously recommends a vote “FOR” each of proposals ONE and TWO as set forth in this Proxy Statement.

| 1 |

ELECTION OF DIRECTORSONE CLASS A DIRECTOR TO HOLD OFFICE UNTIL THE 2021 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL HIS SUCCESSOR HAS BEEN DULY ELECTED AND QUALIFIED.

Our business affairs are managed under the direction of the board of directors, or the Board, consisting of fivefour persons, divided into three classes. Members of each class serve offset terms of three years so that only one class is elected each year. Class C, consisting of James C. Leslie, willThe following table sets forth each class, the directors comprising each class and their respective terms:

| CLASS | DIRECTORS | TERM EXPIRING |

| Class A | Troy Phillips* | 2018 Annual Meeting |

| Class B | Anthony J. LeVecchio* Will Cureton* | 2019 Annual Meeting |

| Class C | James C. Leslie | 2020 Annual Meeting |

| * Independent Director as defined by Nasdaq Rule 5605(a)(2). | ||

The Board has nominated Troy Phillips to serve for a term that will expire atas the Annual Meeting of Stockholders in 2008. Class A consisting of Jonathan R. Bloch and David E. Bowe, will continueDirector. Mr. Phillips has indicated his willingness to serve following this Annual Meeting of Stockholders for a term that will expire at the Annual Meeting of Stockholders in 2006. Since the date of our last annual meeting, Anthony J. LeVecchio was appointed as a director to fill the vacancy in the Class B directors and Richard L. Bloch, a Class B director resigned frommember of the Board of Directors, on February 16, 2005. Will Cureton was appointed as a director to fill the vacancyif elected. However, in the Class Bevent he shall become unavailable for election to the Board for any reason not presently known or contemplated, the Proxy holders will be vested with discretionary authority in such instance to vote the enclosed Proxy for such substitute as the Board shall designate

Directors require a plurality of the votes cast in person or by proxy by the Stockholders to be elected. Accordingly, abstentions and broker non-votes will have no effect on the outcome of the election of directors createdassuming a quorum is present or represented by Mr. Bloch’s resignation. Class B directors, now consisting of Mr. LeVecchio and Mr. Cureton, will continue to serve following this Annual Meeting of Stockholders for a term that will expireproxy at the Annual Meeting of Stockholders in 2007.Meeting.

The persons designated as proxies will vote the enclosed proxy for the election of the nomineelisted nominees unless you direct them to withhold your votes. If thea nominee becomes unable to serve as a director before the meeting (or decides not to serve), the individuals named as proxies may vote for a substitute or we may reduce the number of members of the board. The Board recommends that stockholdersStockholders voteFOR the nominee.

Below areis the namesname and agesage of the nominee for the Class CA director and the continuing Class AB and Class BC directors, the years they became directors, their principal occupations or employment for at least the past five years and certain of their other directorships, if any.

Nominee for Election for Term Ending with the 20082021 Annual Meeting

Class A Director

Class C DirectorTroy PhillipsAge 70, director since 2017.Mr. Phillips has been the Chairman of the Board and CEO of Glast, Phillips & Murray, P.C., a law firm, since 1992. Mr. Phillips specializes in business litigation, devoting a substantial portion of his practice to prebankruptcy strategies, loan workouts, purchase of assets from bankruptcy estates, and refinancings. He also has extensive experience in corporate reorganizations, leveraged buy-outs and avoidance of prebankruptcy transfers. Mr. Phillips has practiced law privately since 1974. Mr. Phillips received his bachelor's degree from North Texas State University and his law degree from the University of Texas at Austin in 1974, where he was a member of the Order of Barristers and the University of Texas State Champion Moot Court Team. He is a member of the College of the State Bar of Texas and is an occasional speaker at legal and professional seminars as well as an author on business bankruptcy law. Mr. Phillips has been admitted to practice and has handled cases before Courts in the State of Texas, the Northern and Eastern Federal Districts of Texas, the Fifth Circuit Court of Appeals, and the United States Supreme Court. Mr. Phillips has been nominated to serve as a director in part because of his legal and business acumen that can greatly benefit the Company.

The Board recommends a vote “FOR” the election of such nominee.

The enclosed Proxy will be voted as specified, but if no specification is made, it will be voted “FOR” the election of Mr. Phillips as a Class A Director.

|

|

Since March 2001, Mr. Leslie has focused primarily on managing his personal investments. Mr. Leslie has positions in one or more subsidiaries, or affiliates, of Ascendant. From 1996 through March 2001, Mr. Leslie served as President and Chief Operating Officer of The Staubach Company, a full-service international real estate strategy and services firm. From 1988 through March 2001, Mr. Leslie also served as a director of The Staubach Company. Mr. Leslie was President of Staubach Financial Services from January 1992 until February 1996. From 1982 until January 1992, Mr. Leslie served as Chief Financial Officer of The Staubach Company. Mr. Leslie serves on the board of Stratus Properties, Inc. and serves on boards of several private companies. Mr. Leslie holds a B.S. degree from The University of Nebraska and an M.B.A. degree from The University of Michigan Graduate School of Business.

Directors Continuing in Office Until the 2006with 2019 Annual Meeting

Class B Directors

Class AAnthony J. LeVecchioAge 71, director since 2004.Mr. LeVecchio has been the President and Principal of The James Group, a general business consulting firm that has advised clients across a range of high-tech industries, since 1988. Prior to forming The James Group in 1988, Mr. LeVecchio was the Senior Vice President and Chief Financial Officer for VHA Southwest, Inc., a regional healthcare system. Mr. LeVecchio currently serves as director, advisor and executive of private and public companies in a variety of industries. He currently serves as Co-Chairman of the Board of Directors of UniPixel, Inc. (UNXL) an industrial film design and manufacturing firm in Santa Clara, California that is listed on The NASDAQ Global Market, and serves on the Audit Committee. He also currently serves as Chairman of the Board of Directors and as Chairman of the Audit Committee for LegacyTexas Bank (LTXB), a community bank based in Plano, Texas that is listed on The NASDAQ Global Select Market. His prior public company boards include Microtune, Inc., DG FastChannel, Inc., and Maxum Health, Inc. Mr. LeVecchio holds a Bachelor of Economics and a M.B.A. in Finance from Rollins College where he serves on the Board of Trustees. Mr. LeVecchio is a lecturing professor for financial statement analysis classes at the University of Texas, Dallas. Mr. LeVecchio was selected to serve on our Board and as the Chairman of the Audit Committee because of his standing as a financial expert and corporate governance expert.

Will CuretonAge 67, director since 2005.Mr. Cureton is President of Richman Southwest Development, LLC, an affiliate of The Richman Group of Companies, which focuses on condo and multifamily projects. From 1997 to 2013, Mr. Cureton was a member and manager of CLB Holdings, LLC, a Texas limited liability company and general partner of CLB Partners, Ltd., a Texas limited partnership ("CLB") engaged in real estate development and which he co-founded in 1997. Prior to co-founding CLB, Mr. Cureton was Chief Operating Officer of Columbus Realty Trust, a real estate investment trust, from 1993 to 1997. In 1987 Mr. Cureton co-founded Texana, a commercial real estate investment and property management company, and served as its President and Chief Executive Officer until 1993. From 1981 to 1987, Mr. Cureton served as an executive officer with The DicoGroup, Inc., a Dallas based real estate investment company. Mr. Cureton started his career with Coopers & Lybrand, where he worked from 1974 to 1981. Mr. Cureton received a Bachelor of Business Administration degree in accounting from East Texas State University (now known as Texas A&M University - Commerce). Mr. Cureton was selected to serve on our Board because of his extensive business dealings. | ||

| ||

DirectorsDirector Continuing in Office Until the 20072020 Annual Meeting

| ||

| ||

AllJames C. LeslieAge 62, a director since July 2001, Chairman of the Board since March 2002 and Interim President, Interim Chief Financial Officer and Secretary since January 2018.Mr. Leslie assumed the role of Interim President and Chief Financial Officer in January, 2018 and has served as Chairman of Dougherty’s since March 2002 and as a Director since July 2001. Mr. Leslie Mr. Leslie held the position of Chief Executive Officer of CRESA, a national tenant representation and real estate advisory services firm headquartered in Boston, Massachusetts from 2012 to 2015, after serving on its Board for 10 years. From 2001 to 2011, Mr. Leslie focused primarily on managing his personal investments. Mr. Leslie has positions in one or more subsidiaries, or affiliates, of Dougherty’s Pharmacy. From 1996 through 2001, Mr. Leslie served as President and Chief Operating Officer of The Staubach Company, a full-service international real estate strategy and services firm. From 1988 through March 2001, Mr. Leslie also served as a director of The Staubach Company. Mr. Leslie was President of Staubach Financial Services from 1992 until 1996. From 1982 until 1992, Mr. Leslie served as Chief Financial Officer of The Staubach Company. Mr. Leslie serves on boards of several private companies. Mr. Leslie holds a B.S. degree from The University of Nebraska and an M.B.A. degree from The University of Michigan Graduate School of Business. Mr. Leslie was selected to serve as Chairman of the Board because of his leadership, financial and management experience as well as his ability to provide guidance and valuable insight through his involvement with entrepreneurs and emerging companies consistently during his career.

The positions of the foregoing persons are currently directors. Their positionsas directors on standing committees of the Board of Directors are shown below under “Committees"Committees of the Board of Directors; Meetings”Meetings".

There are no family relationships among the executive officersofficer or directors. There are no arrangements or understandings pursuant to which any of these persons were elected as an executive officer or director. No director or officer has been involved in any legal proceedings required to be disclosed under Item 401(f) of Regulation SK, but for a personal bankruptcy filed in 2013 by one of our directors, Mr. Will Cureton.

Gary W. Boyd,39, has served as

| 3 |

COMPENSATION OF DIRECTORS

Non Employee Director Compensation

As of December 31, 2017

| Annual Cash Retainer | Per Meeting Fees | Annual Restricted Stock Grant | ||

| Non-Employee Director $10,000; $2,500 per quarter | In person $500, telephonic $250 | 20,000 shares vesting over four years | ||

| Non-Employee Director and Committee Chairman $20,000; $5,000 per quarter | In person $500, telephonic $250 | 20,000 shares vesting over four years | ||

| Non-Employee Director and Chairman of the Board $120,000; $10,000 per month | In person $500, telephonic $250 | 20,000 shares vesting over four years |

2017 Director Compensation Table

| Name | Fees Earned or Paid in Cash | Nonqualified Deferred Compensation Earnings | Total | |||||||||

| ($) | ($) | ($) | ||||||||||

| James C. Leslie | $ | 120,000 | $ | 2,566 | $ | 122,566 | ||||||

| Anthony J. LeVecchio | $ | 22,500 | $ | 2,566 | $ | 25,066 | ||||||

| Will Cureton | $ | 12,000 | $ | 2,566 | $ | 14,566 | ||||||

| Troy Phillips | $ | 3,500 | $ | – | $ | 3,500 | ||||||

Note: Nonqualified deferred compensation earnings represent the market value of vested shares under our Vice President-Finance and Chief Financial Officer since October 2004. From 1987 to 1994, Mr. Boyd was an accountant with Coopers & Lybrand, LLP, serving as an audit manager from 1991 to 1994. From 1994 to 1996, Mr. Boyd was the controllerRestricted Share Unit (“RSU”) Incentive Plan.

CORPORATE GOVERNANCE

The business affairs of Summit Acceptance Corporation, a national financial services company, and from 1996 to 2000, Mr. Boyd served as the Chief Financial Officer and Secretary of Summit Acceptance Corporation. From 2001 to 2002, Mr. Boyd was the Vice President—Finance of PARAGO, Inc., a technology based service provider to the promotions management industry. From January 2003 until he joined the Company Mr. Boyd wasare managed under the Vice President—Financedirection of CountryPlace Mortgage, Ltd.,the Board. The Board meets on a subsidiaryregularly scheduled basis during the fiscal year of Palm Harbor Homes, Inc., a company listedthe Company to review significant developments affecting the Company and to act on the Nasdaq that manufactures, markets and finances multi-section manufactured and modular homes. Mr. Boyd received a Bachelor of Business Administration degreematters requiring Board approval. It also holds special meetings as required from Baylor University in 1987 and is a certified public accountant.

Compensationtime to time when important matters arise requiring Board action between scheduled meetings. The Board of Directors

Jonathan Bloch and Will Cureton, as non-employee directors are compensated $500 for or its authorized committees met 8 times during the 2017 fiscal year. During fiscal year 2017, each board meeting attendeddirector participated in personat least 75% or $250 for each board meeting attended telephonically, in addition to reimbursementmore of out-of-pocket expenses. Anthony J. LeVecchio is compensated $8,750 per quarter for his services as a memberthe aggregate of (1) the total number of meetings of the Board of Directors (held during the period for which he was a director) and as Chairman(2) the total number of meetings of all committees of the Audit Committee. Our directors are eligible to receive stock option grants under our 1999 Long-Term Incentive Plan and various types of long-term incentive awards under our

2002 Equity Incentive Plan. For descriptionsBoard Leadership Structure

The current leadership structure of the 1999 Long-Term Incentive Plan andCompany provides for the 2002 Equity Incentive Plan, please seecombination of the discussions set forth inroles of the section titled “Management.” On June 25, 2004, 17,500 shares of restricted stock were issued to Anthony J. LeVecchio under our 2002 Equity Incentive Plan. In addition, James C. Leslie, Chairman of the Board was paid an annual retainer of $50,000 for his serviceand the Interim Chief Executive Officer. The Board believes that the Interim Chief Executive Officer is best situated to serve as the Chairman of the Board because he is the director most familiar with the Company’s business and industry, and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. The Chairman of the Board also serves as the Company’s Interim Chief Financial Officer. Independent directors and management have different perspectives and roles in 2004.strategy development. The Company’s independent directors bring experience, oversight and expertise from outside the Company and industry, while the Chief Executive Officer brings Company-specific experience and expertise. One of the key responsibilities of the Board is to develop the Company’s strategic direction and hold management accountable for the execution of strategy once it is developed. The Company believes that the combined role of Chairman of the Board and the Interim Chief Executive Officer/Interim Chief Financial Officer is in the best interest of the Company’s stockholders because it promotes strategy development and execution, and facilitates information flow between management and the Board, which are essential to effective governance of the Company.

| 4 |

The Company also believes that the combined role of the Chairman of the Board and the Interim Chief Executive Officer is appropriate in light of the independent oversight of the Board. Although the Board has not designated a lead independent director, the Company has a long history of strong independent directors, with 3 out of the 4 current members of the Board (Messrs. Cureton, LeVecchio, and Phillips) being independent. In addition, the Audit and Compensation Committees of the Board are composed solely of independent directors. The Board regularly reviews the Company’s leadership structure and reserves the right to alter the structure as it deems appropriate.

Board Role in Risk Oversight and Management

The Board has an active role in the oversight and management of the Company’s risks and carries out its role directly and through Board committees. The Board’s direct role in the Company’s risk management process includes regular or periodic receipt and discussion of reports from management and the Company’s outside counsel and advisers on areas of material risk to the Company, including operational, strategic, financial, legal and regulatory risks.

The Board has also historically delegated the oversight and management of certain risks to the Audit and Compensation Committees of the Board. The Audit Committee is responsible for the oversight of Company risks relating to accounting matters, financial reporting and related party transactions. To satisfy these oversight responsibilities, the Audit Committee regularly meets with and receives and discusses reports from the Chief Financial Officer, the Company’s independent registered public accountant, and the Company’s outside counsel. The Compensation Committee is responsible for the oversight of risks relating to the Company’s compensation and benefit programs. To satisfy these oversight responsibilities, the Compensation Committee regularly meets with and receives and discusses reports from the Interim Chief Executive Officer/Interim Chief Financial Officer to understand the financial, human resources and stockholder implications of compensation and benefit decisions.

The Board has also addressed risk through the adoption of corporate policies. The Board has adopted a Code of Business Conduct and Ethics designed to ensure that directors, officers and employees of the Company are aware of their legal and ethical responsibilities and conduct the Company’s business in a consistently legal and ethical manner.

Committees of the Board of Directors; Meetings

During the year ended December 31, 2004, the entire Board met four times and acted five times by unanimous written consent. During fiscal 2004, no director attended fewer than 75% of the aggregate number of meetings of the Board and committees on which such director served.

The Board has threetwo standing committees, the Audit Committee the Compensation Committee and the Related Party TransactionsCompensation Committee. The Board does not have a separate Nominating Committee and performs all of the functions of that committee.

The Audit Committee.Committee

The Audit Committee has as its primary responsibilities the appointment of the independent auditor for the Company, the pre-approval of all audit and non-audit services, and assistance to the Board in monitoring the integrity of our financial statements, the independent auditor’sauditor's qualifications, independence and performance and our compliance with legal requirements. The Audit Committee operates under a written charter adopted by the Board, a copy of which is available on the Company’sCompany's website at www.ascendantsolutions.com. During the year ended December 31, 2004, the Audit Committee met four times. Jonathan R. Bloch andwww.doughertys.com (the contents of such website are not incorporated into this Registration Statement). Anthony J. LeVecchio areis the current membersmember and Chairman of the Audit Committee.

The Securities and Exchange Commission (“SEC”("SEC") has adopted rules to implement certain requirements of the Sarbanes-Oxley Act of 2002 pertaining to public company audit committees. One of the rules adopted by the SEC requires a company to disclose whether the members of its Audit Committee are “independent.”"independent." Since we are not a “listed”"listed" company, we are not subject to rules requiring the members of our Audit Committee to be independent. The SEC also requires a company to disclose whether it has an “Audit"Audit Committee Financial Expert”Expert" serving on its audit committee.

Based on its review of the applicable rules of The Nasdaq NationalNASDAQ Global Market governing audit committee membership, the Board believes that Mr. LeVecchio is “independent”"independent" within the meaning of NasdaqThe NASDAQ Global Market listing standards but does not believe that Mr. Bloch is “independent” within the meaning of such rules.standards. The Board does believe that both membersthe current member of the Audit Committee satisfysatisfies the general definition of an independent director under Nasdaq’sThe NASDAQ Marketplace Rule 4200, but Mr. Bloch fails to satisfy the more stringent requirements applicable to audit committees under Rule 4350 in view of Richard L. Bloch’s beneficial ownership of 16.2% of our common stock and Jonathan Bloch’s family relationship with Richard Bloch.5600(a)(2).

| 5 |

Based on its review of the criteria of an Audit Committee Financial Expert under the rule adopted by the SEC, the Board, after reviewing all of the relevant facts, circumstances and attributes, has determined that Mr. LeVecchio, the Chairman of the Audit Committee is the sole “auditqualified as an "audit committee financial expert”expert" on the Audit Committee.

Compensation Committee.Committee

The Compensation Committee recommends to the Board annual salaries for seniorexecutive management and reviews all company benefit plans. During the year ended December 31, 2004, theThe Compensation Committee had no formal meetings, insteadoperates under a written charter adopted by the full Board, performed these functions.a copy of which is available on the Company's website at www.doughertys.com (the contents of such website are not incorporated into this Registrations Statement). The current membersChairman of the Compensation Committee are Jonathan R. Bloch andposition is open. The current member of the Compensation Committee is Anthony J. LeVecchio. After a review of the applicable rules of The NASDAQ Global Market governing compensation committee membership, the Board believes that Mr. LeVecchio is “independent” within the meaning of The NASDAQ Global Market Listing Standards.

Related Party Transactions Committee. The Related Party Transactions Committee was created on February 15, 2005 and is responsible for the review of all related party transactions for potential conflict of

interest situations on an ongoing basis, including transactions with management, certain business relationships, and indebtedness of management. The current members of the Related Party Transactions Committee are Jonathan R. Bloch and Anthony J. LeVecchio.Nomination Process

Nomination Process.The Board does not have a separate Nominating Committee or Charter and performs all of the functions of that committee. The Board believes that it does not need a separate nominating committee because the full Board is relatively small, has the time to perform the functions of selecting Board nominees, and in the past has acted unanimously in regard to nominees. The Board has also considered that two of its members, Will Cureton and James C. Leslie, constitute two of the three persons who have voting control with respect to 7,646,000 shares of common stock, or 35% of the shares entitled to vote, as discussed in the footnotes in “Stock Ownership.”

In view of Ascendant’sDougherty’s size, resources and limited scope of operations, Thethe Board has determined that it will not increase the size of the Board from its current size of five members.members, including the current vacancy in the Class A director position that the Board intends to fill. In the future, the Board may determine that increased size, scope of operations or other factors would make it advisable to add additional directors. In considering an incumbent director whose term of office is to expire, the Board reviews the director’sdirector's overall service during the person’sperson's term, the number of meetings attended, level of participation and quality of performance. In the case of new directors, the directors will consider suggestions from many sources, including stockholders, regarding possible candidates for directors. The Board may engage a professional search firm to locate nominees for the position of director of the Company. However, to date the Board has not engaged professional search firms for this purpose. A selection of a nominee by the Board requires a majority vote of the Company’sCompany's directors.

The Board seeks candidates for nomination to the position of director who have excellent decision-making ability, business experience, personal integrity and a high reputation and who meet such other criteria as may be set forth in a writing adopted by a majority vote of the Board of Directors. The committee will use the same criteria in evaluating candidates suggested by stockholders as for candidates suggested by other sources.

Pursuant to a policy adopted by the Board, the directors will take into consideration a director nominee submitted to the Company by a stockholder; provided that the stockholder submits the director nominee and reasonable supporting material concerning the nominee by the due date for a stockholder proposal to be included in the Company’sCompany's proxy statement for the applicable annual meeting as set forth in the rules of the Securities and Exchange Commission then in effect. See “Annual Meeting Advance Notice Requirements” below.

Director Attendance at Annual Meetings.Meetings

We do not have a policy regarding attendance by members of the Board of Directors at our annual meeting of stockholders. The Board has always encouraged its members to attend its annual meeting. In 2004, two directors (Mr. Leslie and Mr. Bowe) attended our annual meeting of stockholders.

Stockholder Communications With The Board.Board

Historically, we have not had a formal process for stockholder communications with the Board. We have made an effort to insureensure that views expressed by a stockholder are presented to the Board. During the upcoming year, the Board may give consideration to the adoption of a formal process for stockholder communications with the Board.

Code of Business Conduct and Ethics.

| 6 |

CODE OF BUSINESS CONDUCT AND ETHICS

The Board adopted a Code of Business Conduct and Ethics on May 19, 2004,August 16, 2017, a copy of which is available on the Company's website at www.doughertys.com (the contents of such website are not incorporated into this proxy statement). The Company intends to disclose future amendments to, or waivers from, certain provisions of the Codes of Ethics on the Company’s website within four business days following the date of such amendment or waiver. Upon the written request of any stockholder, the Company will furnish, without charge, a copy of each of the Codes. This request should be directed to the Company’s Secretary at www.ascendantsolutions.com.

STOCK OWNERSHIPthe address indicated above.

Beneficial Ownership of Certain Stockholders, Directors and Executive Officers

The following table sets forth information with respect to the beneficial ownership of our common stock at March 31, 2005,16, 2018, by:

| · | each of our named executive officers and directors; | |

| · | all of our executive officers and directors as a group; and | |

| · | each person or group of affiliated persons, known to us to own beneficially more than 5% of our common stock |

In accordance with the rules of the SEC, the table gives effect to the shares of common stock that could be issued upon the exercisevesting of outstanding options and common stock purchase warrantsrestricted share units within 60 days of March 31, 2005.16, 2018. Unless otherwise noted in the footnotes to the table, and subject to community property laws where applicable, the following individuals listed in the table have sole voting and investment control with respect to the shares beneficially owned by them. Unless otherwise noted in the footnotes to the table, the address of each stockholder, executive officer and director is c/o Ascendant Solutions,Dougherty’s Pharmacy, Inc., 16250 Dallas Parkway,5924 Royal Lane, Suite 102,250, Dallas, Texas 75248.75230. We have calculated the percentages of shares beneficially owned based on 21,933,40023,087,164 shares of common stock outstanding at March 31, 2005.16, 2018.

Shares of Common Stock beneficially owned | |||||

Person or group | Number | Percent | |||

David E. Bowe (1) | 1,165,250 | 5.2 | % | ||

Jonathan R. Bloch (2) | 1,040,000 | 4.5 | % | ||

James C. Leslie (3) | 4,446,000 | 20.0 | % | ||

Richard L. Bloch (4)(5) | 3,575,000 | 16.3 | % | ||

CLB Partners, Ltd. (5) | 3,500,000 | 16.0 | % | ||

Will Cureton (5)(6) | 3,500,000 | 16.0 | % | ||

Anthony J. LeVecchio | 57,500 | * | |||

Gary W. Boyd | 50,000 | * | |||

All executive officers and directors as a group (6 persons)(7) | 10,274,050 | 43.1 | % | ||

| Shares of Common Stock Beneficially Owned * | ||||||||||

| Person or Group | Number | Percentage | ||||||||

| Directors and Named Executive Officers | ||||||||||

| James C. Leslie (Director, Chairman of the Board, Interim President and Chief Financial Officer) | 1,821,315 | (1)(2) | 7.9% | |||||||

| Mark Heil (President and Chief Financial Officer) | 297,882 | (2) | 1.3% | |||||||

| Anthony J. LeVecchio (Director) | 352,973 | 1.5% | ||||||||

| Will Cureton (Director) | 52,231 | * | ||||||||

| Troy Phillips (Director) | 3,779,743 | 16.4% | ||||||||

| All Executive Officers and Directors as a Group (5 Persons) | 6,304,144 | 27.3% | ||||||||

| * Denotes less than one percent. | ||||||||||

| (1) | Includes |

| (2) |

Section 16(a) Beneficial Ownership Reporting ComplianceChange in Control Arrangements.

There are no arrangements, known to the Company, including any pledge by any person of the Company’s securities or any of its parents, the operation of which may at a subsequent date result in a change in control of the Company.

| 7 |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under U.S. securities laws, directors, certain executive officers and persons holding more than 10% of our common stock must report their initial ownership of the common stock, and any changes in that ownership, to the SEC. The SEC has designated specific due dates for these reports. Based solely on our review of copies of the reports filed with the SEC and written representations of our directors and executive officers, we believe that all persons subject to reporting filed the required reports on time in 2004, except that Richard L. Bloch reported an option exercise made on June 8, 2004 on a2017, other than six late Form 4 filed on June 21, 2004.

Our executive3 filings for our directors and officers are David E. Bowe and Gary W. Boyd.

Summary compensation. The following table provides summary information concerning compensation paid by us to David E. Bowe, our President and Chief Executive Officer, and Gary W. Boyd, our Chief Financial Officer (the “named executive officers”). In 2004, no other person who served as an executive officer of Ascendant Solutions at any time during the year had total annual salary and bonus in excess of $100,000. In 2002, David E. Bowe’s salary was reduced and he was awarded certain performance-based options and restricted stock, in part, in exchange for the reduction in salary to be paid to him. See “Compensation Committee Report—Chief Executive Officer Compensation.”

| Year | Annual Compensation | Long-Term Compensation Award | All Other Compensation ($) | |||||||||||||||||

Name and Principal Positions | Salary ($) | Bonus ($) | Restricted Stock Awards ($) | Securities Underlying Options (#) | ||||||||||||||||

David E. Bowe | 2004 | $ | 100,000 | — | — | — | $ | 4,000 | (1) | |||||||||||

| President and Chief | 2003 | $ | 100,000 | — | — | — | $ | 1,333 | (1) | |||||||||||

| Executive Officer | 2002 | $ | 118,750 | — | $ | 153,000 | (2) | 600,000 | (3) | — | ||||||||||

Gary W. Boyd | 2004 | $ | 31,250 | (4) | $ | 15,000 | $ | 55,000 | (4) | — | — | |||||||||

| Vice President-Finance and | 2003 | — | — | — | — | — | ||||||||||||||

| Chief Financial Officer | 2002 | — | — | — | — | — | ||||||||||||||

Option Grants in Last Fiscal Year. There were no option grants during the fiscal year ended December 31, 2004.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values. The following table provides information regarding options that were exercised during the fiscal year ended December 31, 2004, the number of shares covered by both exercisable and unexercisable stock options as of December 31, 2004, and the values of “in-the-money” options, which values represent the positive spread between the exercise price of any such option and the fiscal year-end value of our common stock for our named executive officers.

Name | Shares Acquired on Exercise | Value Realized | Number of securities options at fiscal year-end | Value of the unexercised in-the-money options at fiscal year-end | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

David E. Bowe | 50,000 | $ | 40,500 | 550,000 | — | $ | 522,500 | $ | — | ||||||

Our 1999 Long-Term Incentive Plan, approved by the board of directors on May 12, 1999, and subsequently amended, currently provides for the issuance to qualified participants of up to 2,500,000 shares of our common stock pursuant to the grant of stock options. The purpose of our 1999 Long-Term Incentive Plan is to promote our interests and the interests of our stockholders by using investment interests in Ascendant Solutions, Inc. to attract, retain and motivate eligible persons, to encourage and reward their contributions to the performance of Ascendant Solutions and to align their interests with the interests of our stockholders. As of March 31, 2005, unexercised options to purchase 1,140,000 shares of common stock were outstanding, having a weighted average exercise price of $0.26 per share, under the 1999 Long-Term Incentive Plan. Of these, options to purchase 10,000 shares of common stock are intended to qualify as Incentive Stock Options under Section 422 of the Code. The remaining options to purchase 1,130,000 shares of common stock are nonqualified stock options.

The outstanding and unexercised options include 235,000 that were granted to Jonathan R. Bloch and 25,000 that were granted to Richard Bloch on March 14, 2002 at an exercise price of $0.24 per share. These options are exercisable in three installments beginning in March 2003 and expire in 2012. The outstanding options also include 550,000 options remaining out of the 600,000 performance based options granted to David E. Bowe on March 14, 2002, and 300,000 options remaining out of the 400,000 performance based options granted to James C. Leslie on March 14, 2002, each grant at an exercise price of $0.24 per share. The performance based options vest annually over six years beginning in March 2003 with the potential to vest earlier upon achievement of pre-established performance goals. In May 2004, these performance goals were achieved and the board of directors accelerated the vesting of the remaining unvested options.

The board of directors adopted the 2002 Equity Incentive Plan on March 14, 2002 and the stockholders approved it at the 2002 Annual Meeting. The purpose of the 2002 Equity Incentive Plan is to provide a means by which selected employees of and consultants to the Company and its affiliates may be given an opportunity to acquire a proprietary interest in the Company. Under the 2002 Equity Incentive Plan, the Company may provide various types of long-term incentive awards, including Options, Stock Appreciation Rights, Restricted Stock, Deferred Stock, Stock Reload Options and Other Stock-Based Awards, in order to retain the services of persons who are now employees of or consultants to the Company and its affiliates, to secure and retain the services of new employees and consultants, and to provide incentives for such persons to exert maximum efforts for the success of the Company and its affiliates. The 2002 Equity Incentive Plan currently provides for the issuance of awards of up to 2,000,000 shares of our common stock. As of March 31, 2005, 502,500 shares of restricted stock had been granted under the 2002 Equity Incentive Plan.

In September 2003, the Company began participating in a new 401(k) plan that matches 4%. Total contributions by the Company were $6,600 in 2004.

Compensation Committee Interlocks and Insider Participation

The board has appointed a Compensation Committee consisting of Jonathan R. Bloch and Anthony J. LeVecchio. The Compensation Committee had no formal meetings during 2004; instead the full board performed those functions. The Compensation Committee studies, advises and consults with management respecting the compensation of our officers, and administers our stock-based compensation plans. It also recommends for the board’s consideration any plan for additional compensation that it deems appropriate. During the last fiscal year, no executive officer or employee of Ascendant Solutions served as a member of the Compensation Committee. However, since the Compensation Committee did not meet and the full board performed these functions, both David Bowe and James Leslie participated in the board’s deliberations concerning executive compensation, however, neither received an increase in their compensation in 2004.

Certain Relationships and Related Transactions

Since May 1, 2002, we have sublet our office space from JamJen, Inc., an entity controlled by James Leslie. Mr. Leslie controls, and Richard Bloch, the father of Jonathan Bloch, and Will Cureton are indirectly limited partners in, the entity that owns the building in which the office space is leased by JamJen. We currently pay monthly rent of approximately $1,800. CRESA Capital Markets Group, L.P. (“Capital Markets”), a limited partnership we control and in which we hold an 80% interest, also shares the space and pays monthly rent to JamJen and an affiliated entity controlled by two principals of Capital Markets of approximately $3,100. In connection with our sharing of office space with JamJen, we incur certain shared costs with JamJen, which gives rise to reimbursements from us to JamJen. These costs were approximately $22,800 in 2004. During the year ended December 31, 2004, we paid approximately $26,100 and Capital Markets paid approximately $41,100 in rent. We have not entered into a lease with JamJen, but rather are renting our office space on a month-to-month basis. We believe that such arrangement has been on terms no less favorable to us than could have been obtained in a transaction with an independent third party.

Mr. Leslie is also an employee of Capital Markets. In 2002, Capital Markets entered into a licensing and co-marketing agreement with CRESA Partners, LLC, a national real estate services firm, under which Capital Markets is obligated to pay 15% of its gross revenues to CRESA Partners (as further defined in its licensing and co-marketing agreement) and to pay additional referral fees in certain circumstances. During 2004, we paid $129,500 to CRESA Partners. Mr. Leslie serves as an advisor to the board of directors of CRESA Partners.

During the fourth quarter of 2003, we entered into a participation agreement (the “Participation Agreement”) with Fairways Equities LLC, an entity controlled by Mr. Leslie and Brant Bryan, Cathy Sweeney and David Stringfield who are principals of Capital Markets and stockholders of the Company (the “Fairways Members”), pursuant to which we will receive up to 20% of the profits realized by Fairwaysdue in connection with all real estate acquisitions made by Fairways Equities LLC. Our profit participation with the Fairways Members is subject to modification or termination by Fairways Equities LLC at the endeffectiveness of 2005 in the event that the aggregate level of cash flow (as defined in the Participation Agreement) generated by acquired operating entities has not reached $2 million for the twelve months ended December 31, 2005. We do not have an investment in Fairways Equities LLC, but rather have a profits interest through our Participation Agreement.Form 10 Registration Statement.

In April 2004, we invested approximately $97,000 through ASE Investments Corporation for a 24.75% interest in Fairways 36864, LP, (whose other partners included Mr. Leslie and the Fairways Members) that participated in the development of and leaseback of single tenant commercial properties. In August and October 2004, respectively, these properties were sold and we recognized investment income of $84,000 in addition to the return of our original investment of $97,000. The terms of our investment were on the same basis as our other partners. We own 80% of Capital Markets through our 80% ownership of ASE Investments Corporation and our 100% ownership of Ascendant CRESA LLC, which is the 0.1% general partner in Capital Markets. ASE Investments owns 99.9% of Capital Markets. The remaining 20% of Capital Markets and ASE Investments is owned, directly or indirectly, by the Fairways Members.

On December 31, 2004, we acquired certain indirect interests in various partnerships (the “Frisco Square Partnerships”) that own properties (the “Properties”) in the 150 acre Frisco Square mixed-use real estate development in Frisco, Texas, pursuant to a Master Agreement Regarding Frisco Square Partnerships, dated December 31, 2004 (the “Master Agreement”). We made our investment of $ 154,000 on December 31, 2004 as a limited partner of Fairways Frisco L.P. (“Fairways Frisco”), which is a 49.5% limited partner in each of the Frisco Square Partnerships. Fairways Frisco holds the remaining 0.5% interest through its ownership of 100% of the membership interests of other members of the co-general partners of the Frisco Square Partnerships (the “Fairways Group”). Fairways Equities LLC, an entity controlled by Mr. Leslie and the Fairways Members, is the sole general partner of Fairways Frisco and holds a 0.1% general partner interest in Fairways Frisco. Fairways Frisco has agreed to make capital contributions to the various Frisco Square Partnerships in the aggregate amount of up to $6,280,000. CLB Partners, Ltd., a limited partnership in which Will Cureton, a director, and Richard

Bloch, the father of Jonathan Bloch, each have an ownership interest in the general partner and are limited partners, is also an investor in Fairways Frisco. If the Frisco Square Partnerships generate distributable cash flow, the first $1 Million in aggregate shall be distributed to the Fairways Group and the second $2.5 Million in aggregate shall be distributed to the Five Star Group. Thereafter, the distributions of cash flow are to be made according to the respective partnership interests. If at any time after December 31, 2005, any partner of the Frisco Square Partnerships desires to sell its partnership interests, a buy/sell agreement is set forth in the Master Agreement which could require the other partners to buy such interests or sell their own. Notwithstanding the above, Fairways Frisco may transfer its interest in the Frisco Square Partnerships to any person controlled or managed by Mr. Leslie.

The Company made an investment in Fairways 03 New Jersey, LP in December 2003, along with Mr. Leslie and Fairways Members. Such investment was made on substantially the same terms as the other limited partners in Fairways 03 New Jersey, LP. We received distributions of approximately $208,000 representing our share of the net rental payments, after debt service, during the year ended December 31, 2004. In January 2005, we agreed to indemnify our partners in the Fairways 03 New Jersey, LP investment (including Mr. Leslie) for our 20% pro rata partnership interest of a guarantee of $2.6 million in bank indebtedness which the other partners provided to a bank. The limit of our indemnification under this agreement is our 20% share of any losses those partners may incur under their personal guaranties of the partnership’s bank indebtedness, but shall not exceed $520,000 in the aggregate.

Ascendant Solutions’ executive compensation program is administered by the Compensation Committee of the Board of Directors. The Compensation Committee, which is composed of non-employee directors, is responsible for approving and reporting to the Board on all elements of compensation for the elected corporate officers.

General

David E. Bowe, President and Chief Executive Officer, and Gary W. Boyd, Vice President-Finance and Chief Financial Officer, were the only executive officers serving during fiscal year 2004. Because both officers’ compensation was approved by the entire Board of Directors in 2004, the Compensation Committee did not meet during the fiscal year 2004.

In December 2001, the Company revised its strategic direction to seek acquisition possibilities throughout the United States, make acquisitions or enter into other business endeavors. As a result of two acquisitions in 2004 and other investment activity, the Company will evaluate its need to hire additional executive officers in fiscal 2005 and beyond. To the extent that the Company makes a determination to hire additional executive officers, a compensation package will be offered that is consistent with the policies of the Compensation Committee. The general policies of the Compensation Committee are set forth below.

Compensation Policy

Base Salary. Our goal is to attract, retain and reward a highly competent and productive employee group. Currently, David E. Bowe and Gary W. Boyd are our only executive officers. See “Chief Executive Officer Compensation” below for a discussion of Mr. Bowe’s compensation package. We expect that any future executive officers of the Company would be eligible to receive compensation packages that include a mix of base salary and long-term incentive opportunities and other employee benefits. Changes in compensation are typically based on the individual’s performance, Ascendant Solutions’ financial performance, and the competitive marketplace. Currently, we do not utilize any formal mathematical formula or objective thresholds in determining base salary adjustments. We believe that strict formulas restrict flexibility and are too rigid as the Company continues working through its acquisition and other business strategies.

1999 Long-Term Incentive Plan. The purpose of the 1999 Long-Term Incentive Plan is to promote our interests and the interests of our stockholders by using common stock to attract, retain and motivate eligible persons, to encourage and reward their contributions to the performance of Ascendant Solutions, and to align their interests with the interests of our stockholders. Our directors, officers, employees, consultants and advisors are eligible to receive grants under this plan. With respect to all of our employees other than directors and executive officers, the Compensation Committee has the authority to administer the plan, including the discretion to determine which eligible persons will be granted stock options, the number of shares subject to options, the period of exercise of each option and the terms and conditions of such options. The entire board of directors administers the plan for directors and executive officers. No grants of stock options were made during fiscal 2004 to the executive officers pursuant to the 1999 Long-Term Incentive Plan.

2002 Equity Incentive Plan. The purpose of the 2002 Equity Incentive Plan is to provide a means by which selected employees of and consultants to the Company and its subsidiaries may be given an opportunity to acquire an equity interest in Ascendant Solutions. Our employees, officers, directors, consultants and other persons are deemed to have contributed or to have the potential to contribute to our success. The 2002 Equity Incentive Plan is administered by our Compensation Committee. If from time to time no Compensation Committee is so designated, then the 2002 Equity Incentive Plan will be administered by the Board. No grants of stock options were made during fiscal 2004 pursuant to the 2002 Equity Incentive Plan. Mr. Boyd was granted 50,000 shares of restricted common stock, which vest in three equal annual installments.

Executive Compensation

David E. Bowe and Gary W. Boyd were the only executive officers serving throughout fiscal year 2004. See “Chief Executive Officer Compensation” below for a discussion of Mr. Bowe’s compensation package.

Mr. Boyd’s salary is not currently covered by an employment agreement but when he was hired in October 2004, the Board approved an annual salary in the amount of $150,000 be paid to Mr. Boyd, a signing bonus of $15,000 and a grant of 50,000 shares of restricted stock, such shares vesting equally over a period of three years on the anniversary date of Mr. Boyd’s Restricted Stock Agreement.

James C. Leslie served as the Chairman of the Board throughout fiscal year 2004. In connection with such service, Mr. Leslie was paid an annual retainer of $50,000 for 2004. In addition, during 2004 Mr. Leslie was paid $45,038 by Capital Markets for his services.

Chief Executive Officer Compensation

Mr. Bowe’s salary is not currently covered by an employment agreement but in March 2002, the Board approved a salary in the amount of $100,000 be paid to Mr. Bowe during 2004. In March 2002, the Company granted to Mr. Bowe 600,000 performance-based options under its 1999 Long-Term Incentive Plan for an exercise price of $0.24 per share and 425,000 shares of restricted stock under the Company’s 2002 Equity Incentive Plan. The award of these performance-based options and restricted stock to Mr. Bowe was made, in part, in light of a reduction in salary paid to Mr. Bowe that was made to reduce corporate cash expenses. No grants under the 1999 Long-Term Incentive Plan or the 2002 Equity Incentive Plan were made to Mr. Bowe during fiscal 2004.

The Compensation Committee believes that the base salary of $100,000 for Mr. Bowe for calendar year 2004, when considered in light of the March 2002 grant of performance based options and restricted stock, is appropriate in light of his contribution and efforts with respect to the Company’s operations, the value of his job in the marketplace. When evaluating Mr. Bowe’s contributions to the Company for the past fiscal year the Compensation Committee considered, among other things, Mr. Bowe’s successful completion of the acquisitions of the Park Pharmacy Corporation assets and CRESA Partners of Orange County, Inc., investment in Frisco Square and the continued pursuit of other acquisitions and investment opportunities.

Company Policy on Qualifying Compensation

The Board of Directors periodically reviews the applicability of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”"Code"), which disallows a tax deduction for compensation to an executive officer in excess of $1.0 million per year. In connection with the Board’s periodicalBoard's periodic review of the potential consequences of Section 162(m), the Board may, in the future, structure the performance-based portion of its executive officer compensation to comply with certain exemptions provided in Section 162(m).

The information contained in the Compensation Committee Report shallSeverance and Change In Control Agreements

We have not be deemed to be “soliciting material” or to be “filed” with SEC, nor shall such information be incorporated by referenceentered into any future filing under the Securities Actagreements that provide severance or change in control benefits to any of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference into such filing.our named executive officers.

Compensation CommitteeTABULAR COMPENSATION DISCLOSURE

Jonathan R. Bloch

Anthony J. LeVecchio

PERFORMANCE GRAPHSummary compensation

The following performance graph comparestable provides summary information concerning compensation paid by us to our principal executive officers and each person who served as our principal financial officer in 2017. In 2017, no other person who served as an executive officer of Dougherty’s at any time during the performanceyear had total annual salary and bonus in excess of $100,000.

SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary | Bonus | Other | Nonqualified Deferred Compensation Earnings | Total | ||||||||||||||||

| ($) | ($) | ($)(1) | ($)(3) | ($) | ||||||||||||||||||

| Mark S. Heil | 2017 | $ | 195,000 | – | $ | 3,900 | $ | 5,050 | $ | 203,950 | ||||||||||||

| President and Chief Financial Officer | 2016 | $ | 204,615 | – | $ | 8,223 | $ | 6,383 | $ | 219,221 | ||||||||||||

| Andrew J. Komuves, Jr., | 2017 | $ | 182,000 | $ | 12,603 | $ | 21,154 | (2) | $ | 1,377 | $ | 217,134 | ||||||||||

| President Pharmacy Operations | 2016 | $ | 209,615 | $ | 13,701 | $ | 8,791 | $ | 1,667 | $ | 233,774 | |||||||||||

| (1) | Fully vested matching contributions to the Company’s 401(k) plan, which all participating employees receive. |

| (2) | Includes $18,000 of severance related to the resignation of Mr. Komuves effective October 5, 2017. |

| (3) | Nonqualified deferred compensation earnings represents the market value of vested shares under our RSU Incentive Plan. |

Payments Upon Termination Or Change In Control

The Company’s former President and Chief Financial Officer, Mr. Mark Heil, resigned from his role effective January 17, 2018, to pursue other opportunities. Mr. Heil continued in his present capacity until January 28, 2018, after which time he worked in a transitional role through March 2, 2018. Had Mr. Heil been terminated “without cause” on December 31, 2017, he would have been entitled to continued salary payments for four months following such termination, which would have equaled an aggregate payment over four months equal to $65,000. Mr. James C. Leslie, the Company’s Chairman of the Ascendant SolutionsBoard, now also serves as the Company’s Interim President and Chief Financial Officer in a non-employee capacity, without a formal, written compensation agreement.

| 8 |

The Company’s former President of Pharmacy Operations, Mr. Andrew Komuves, resigned from his role effective October 5, 2017. Mr. Komuves is receiving continued salary payments for the six months following his resignation in the aggregate payment amount equal to $100,000 that was accrued in the financial statements as of September 30, 2017. Mr. Komuves served without a formal, written employment agreement. The last salary payment to Mr. Komuves occurred on April 20, 2018.

The Company could have terminated either Mr. Heil’s or Mr. Komuves’ employment “without cause” for the following:

| · | gross negligence or willful misconduct or malfeasance or the commission of an act constituting dishonesty or other act of material misconduct by the executive that affects the Company, its business, the executive’s employment or his business reputation; |

| · | any violation of the non-disclosure and invention agreement in place between the executive, provided that the Company acts in a bona fide manner; |

| · | any other intentional and material breach, including but not limited to, the material failure of the executive to perform the duties reasonably assigned to him, which is not cured without 30 days of written notice of such breach. |

Restricted Share Unit Incentive Plan

On November 13, 2013, the Board of Directors approved and adopted the RSU Incentive Plan. The plan has not been approved by the stockholders. Under the plan the Company can award RSUs to employees and non-employee directors and consultants pursuant to restricted stock agreements contingent upon continuous service. Under the restricted stock agreements, the restricted shares will vest annually over a four-year period and will be payable in stock, valued at the fair market value on the grant date. There is not a limit on the number of shares that can be issued from the plan and shares are issued from available common stock. As of December 31, 2017, there were 50,000,000 shares authorized, 24,003,310 shared issued and 22,973,310 shares outstanding. The Board considers the number of shares outstanding adequate for purposes of administering the plan.

As of December 31, 2017, the following shares had been issued under the 2013 RSU Plan.

| Year of Issuance: | Number of Shares | Fair Value at Date of Grant | Shares Vested | Non- Vested | Cancelled | |||||||||||||||

| 2013 | 120,000 | $ | 26,400 | 115,000 | – | 5,000 | ||||||||||||||

| 2014 | 122,100 | $ | 30,946 | 86,700 | 25,250 | 10,150 | ||||||||||||||

| 2015 | 150,000 | $ | 39,000 | 65,000 | 65,000 | 15,000 | ||||||||||||||

| 2016 | – | – | – | – | – | |||||||||||||||

| 2017 | 563,000 | $ | 118,230 | – | 543,000 | 20,000 | ||||||||||||||

| 955,100 | $ | 214,576 | 271,700 | 633,250 | 50,150 | |||||||||||||||

Option Grants in Last Fiscal Year

As of December 31, 2017, the Company does not currently have a stock option plan and there are no outstanding options.

| 9 |

Vested Share Units in Last Fiscal Year and Fiscal Year-End Share Unit Values

The following table provides information regarding outstanding restricted stock awards granted to the Nasdaq Market Indexdirectors and an industry peer group, selected in good faith,named executive officers under the RSU Incentive Plan that were still outstanding as of December 31, 2017 and the values of those awards. The value is based on the market price of 14 cents as of December 31, 2017.

| OUTSTANDING EQUITY AWARDS AT YEAR-END | ||||||||

| Stock Awards | ||||||||

| Equity Incentive Plan Awards | ||||||||

| Number of Unearned Units That Have Not Vested | Market or Payout Value of Unearned Units That Have Not Vested | |||||||

| Name | (#) | ($) | ||||||

| James C. Leslie | 15,050 | $ | 2,107 | |||||

| Anthony J. LeVecchio | 15,050 | $ | 2,107 | |||||

| Will Cureton | 15,050 | $ | 2,107 | |||||

| Mark S. Heil | 30,100 | $ | 4,214 | |||||

The following table provides information, for the perioddirectors and named executive officers, on restricted stock awards vested during 2017.

| STOCK VESTED | ||||||||

| Stock Awards | ||||||||

| Equity Incentive Plan Awards | ||||||||

| Number of Share Units Received on Vesting | Value of Share Units Received on Vesting | |||||||

| Name | (#) | ($) | ||||||

| James C. Leslie | 15,150 | $ | 2,516 | |||||

| Anthony J. LeVecchio | 15,150 | $ | 2,516 | |||||

| Will Cureton | 15,150 | $ | 2,516 | |||||

| Mark S. Heil | 30,200 | $ | 4,932 | |||||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Through June 2017, Company co-leased separate office space with entities controlled by the Company’s Chairman in the same building. The Company pays certain operating expenses of the other entities and records receivables due from December 31, 1999,these entities. The Company pays shared office costs of $2,000 through June 2017; $1,000 through December 31, 2004.2017 and $500 thereafter to the entity controlled by the Chairman and records payable due to this entity. At December 31, 2017 and 2016, the Company had net receivables due from these affiliates totaling approximately $6,000 and $12,000, respectively. The graph assumes thatreceivables due from affiliates are classified in current assets based on the valueagreements with the affiliates for repayment.

During 2017, the Company received $18,000 and $1,000 as a portion of the investmentsales commission proceeds, used to offset legal and rent expense, from the entity owned by the Company’s Chairman for the renegotiation of the lease for the Company’s flagship store and the corporate offices, respectively, both located in our common stock and each index was $100.00 atDallas, Texas.

During the years ended December 31, 1999,2017 and that all dividends were reinvested. We have not2016, the Company paid any dividends. Performance data is providedfees to its directors of $49,000 and $56,000, respectively for the last trading day closest to each calendar year end.

On May 11, 2001, Ascendant Solutions’ stock was delisted from The Nasdaq National Market for failure to satisfy the minimum bid price requirement for continued listing set forth in Marketplace Rule 4450(a) or (b) and commenced trading on the OTC Bulletin Board. Effective June 25, 2003, our stock was delisted from the OTC Bulletin Board for failure to comply with NASD Rule 6530,their roles as a result of our failure to timely file our Form 10-Q for the period ended March 31, 2003. Effective June 25, 2003, our common stock became eligible for trading on the National Quotation Bureau’s “Pink Sheets,” under the symbol “ASDS”. We reapplied for listing on the OTC Bulletin Board and recommenced trading effective September 18, 2003

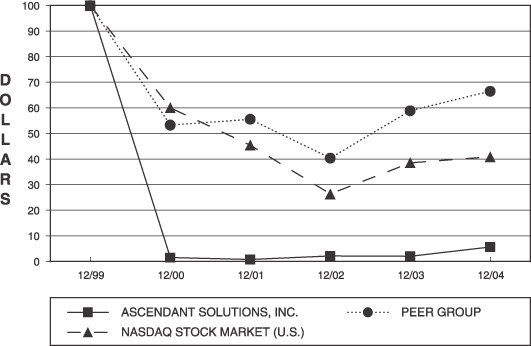

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG ASCENDANT SOLUTIONS, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND A PEER GROUP

* $100 invested on 12/31/99 in stock or index including reinvestment of dividends.

Fiscal year ending December 31.

Company | December 31, 1999 | December 31, 2000 | December 31, 2001 | December 31, 2002 | December 31, 2003 | December 31, 2004 | ||||||

Ascendant Solutions, Inc. | 100.00 | 1.58 | 0.82 | 2.14 | 2.03 | 5.63 | ||||||

Nasdaq Market Index | 100.00 | 60.09 | 45.44 | 26.36 | 38.55 | 40.87 | ||||||

Peer Group (1) | 100.00 | 53.29 | 55.57 | 40.38 | 58.88 | 66.50 |

The Audit Committee oversees the Company’s financial reporting process on behalfmembers of the Board of Directors and operates under a written charter adopted byits related committees. Fees paid to the Board of Directors. One of the rules adopted by the SEC requires a company to disclose whether the members of its Audit Committee are “independent.” Since we are not a “listed” company, we are not subject to rules requiring the members of our Audit Committee to be independent.Company’s Chairman totaled $120,000 for management and other services provided.

Based on its review of the applicable rules of The Nasdaq National Market governing audit committee membership, the Board believes that Mr. LeVecchio is “independent” within the meaning of Nasdaq listing standards but does not believe that Mr. Bloch is “independent” within the meaning of such rules. The Board does believe that both members of the Audit Committee satisfy the general definition of an independent director under Nasdaq’s Rule 4200, but Mr. Bloch fails to satisfy the more stringent requirements applicable to audit committees under Rule 4350 in view of Richard L. Bloch’s beneficial ownership of 16.2% of our common stock and Jonathan Bloch’s family relationship with Richard Bloch. As permitted under exceptional and limited circumstances, however, after careful consideration the Board has determined that Mr. Bloch’s continued service on the audit committee is in the best interests of the Company and its stockholders, because of his knowledge of the Company’s business and industry.

On April 2, 2003, Ernst & Young LLP notified the Company that it did not intend to stand for re-election as the Company’s independent public accountants. The Audit Committee engaged BDO Seidman, LLP as its new independent accountants with the engagement commencing as of June 25, 2003. On November 29, 2004, BDO Seidman, LLP resigned as the Company’s independent public accountants. Effective December 14, 2004, the Audit Committee engaged Hein & Associates LLP as the independent accountants for the year ended December 31, 2004, and has appointed them as independent auditors to examine our consolidated financial statements for the fiscal year ending December 31, 2005 and to render other professional services as required. See “Change in Company’s Certifying Accountant.”

| 10 |

Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewedCompany does not have an official, written policy regarding the review and approval of related party transactions, and the Board deals with the independent auditors, who are responsible for expressingeach situation on an opinion on the conformity of those audited financial statementsindividual basis with generally accepted accounting principles, their judgments as to the quality, not just the acceptability,a majority vote of the Company’s accounting principles andBoard required in order to approve any such other matters as are required to be discussed with the committee under generally accepted auditing standards. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement of Auditing Standards No. 61. The Audit Committee has received the written disclosures and the letter from the independent auditors required by the Independence Standards Board No. 1, which included the independent auditors’ non-audit related tax work, and has discussed with the independent auditors the auditor’s independence from management and the Company.party transaction.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting. The Audit Committee held four meetings during the fiscal year ended 2004.AUDIT COMMITTEE REPORT

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Company’s Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2004 for filing with the Securities and Exchange Commission.

In accordance with the rules of the Securities and Exchange Commission, the foregoing information, which is required by paragraphs (a) and (b) of Regulation S-K Item 306, shall not be deemed to be “soliciting material”"soliciting material" or to be “filed”"filed" with the Commission or subject to the Commission’sCommission's Regulation 14A, other than as provided in that Item, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls.

In this context, the Audit Committee has met and held discussions with management and the independent auditors, Whitley Penn LLP. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors.

The Audit Committee discussed with the independent auditors all matters required to be discussed by Statement on Auditing Standards No. 114 (The Auditor’s Communication with Those Charged with Governance) as adopted by the Public Company Accounting oversight Board in Rule 3200T. In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from the Company and its management, including the matters in the written disclosures received by the Audit Committee from the independent auditors as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) as adopted by the Public Company Accounting Oversight Board in Rule 3600T.

The Audit Committee has determined thatalso considered whether the independent auditors’ provision of non-audit services to the services covered in the preceding paragraphs of this sectionCompany is compatible with maintaining the independence of Hein & Associates LLP.auditors’ independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board approved, the inclusion of the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, for filing with the SEC.

Jonathan R. BlochThis report is submitted by the Audit Committee.

Audit Committee

Anthony J. LeVecchio,

ChairmanCOMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION